Join the trading community

So all of us have essentially been engaged in News Trading since this whole tariff thing started.

Markets were anything but predictable. For the most part, if you took any piece of news at face value, you would have gotten hit real hard.

Tariff was supposed to be positive for the dollar, intended to bring economic expansion, price growth/inflation, and stronger currency – at least that’s one perspective. This did not happen.

While 10 year bond yields spiked, the dollar fell hard especially against safe havens Yen and Swiss Franc.

Then Trump reversed the decisions, by announcing a 90-day pause, and markets rallied. However, the very next day dollar got hit again – only harder.

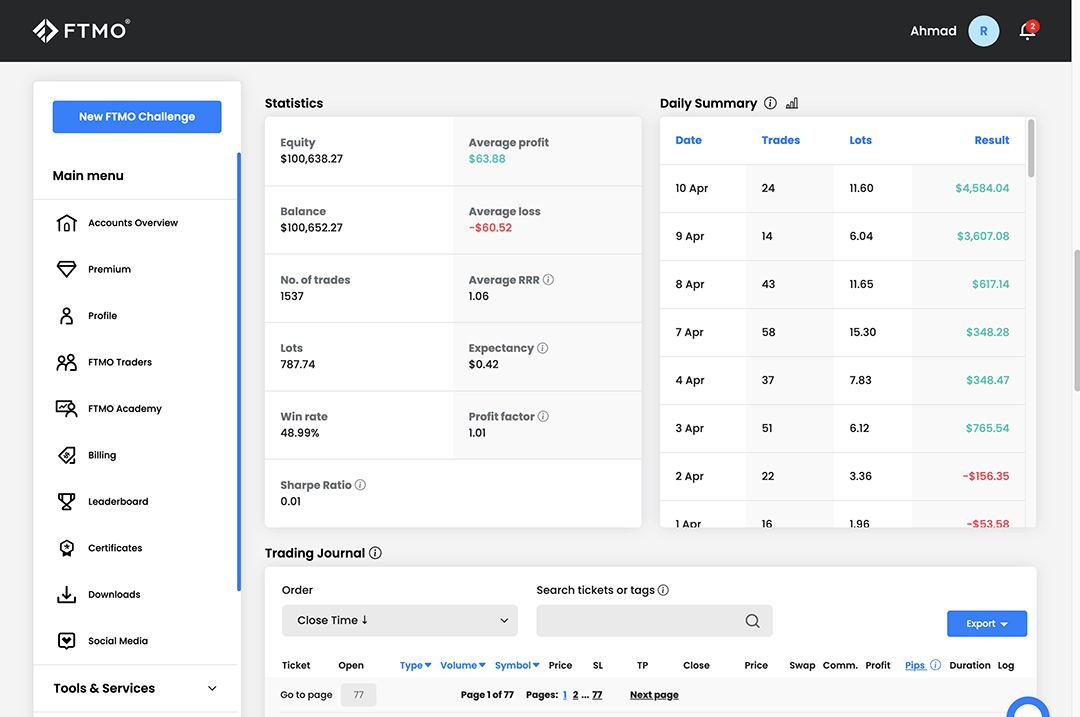

I trade by reacting to price action and momentum and was able to produce a six-day streak of gains with April 10 being the strongest performance to-date.

There’s value in being able to read price charts, so definitely spend time on Technical Analysis. You will learn a ton.